Degree Admissions through DOST Degree Online Services Telangana

Pre – requisites for DOST Registrations:

Admission Schedule, Degree Online Services Telangana (DOST)

| S.NO | Details | From | To |

|---|---|---|---|

| Phase I | |||

| 1 | Notification | 02.05.2025 | |

| 2 | Phase-I Registration (Registration fee Rs.200/-) | 03.05.2025 | 21.05.2025 |

| 3 | Phase-I Web-options | 10.05.2025 | 22.05.2025 |

| 4 | Verification of Special Category Certificates at University HelpLine Centers (UHLCs) |

||

| (i) PH/ CAP | 21.05.2025 | ||

| (ii) NCC/Sports/Extra-Curricular Activities | 22.05.2025 | ||

| 5 | Phase I Seat Allotment | 29.05.2025 | |

| 6 | Online Self-reporting by the seats allotted students | ||

University HelpLine Centers (UHLCs) (PH/CAP/NCC/Sports/Extra-Curricular Activities) 09.06.2025 10 Phase II Seat Allotment 13.06.2025 11 Online Self-reporting by the seats allotted students 13.06.2025 18.06.2025 Phase III 12 Phase III Registration (Registration fee Rs.400/-) 13.06.2025 19.06.2025 13 Phase III Web-options

13.06.2025 19.06.2025 14 Verification of Special Category Certificates at

University HelpLine Centers (UHLCs) (PH/ CAP/ NCC/ Extra-Curricular Activities) 18.06.2025 15 Phase III Seat Allotment 23.06.2025 16 Online Self-reporting by the seats allotted students 23.06.2025 28.06.2025 17 Reporting to colleges by the students who have already confirmed their seats online (self-reporting) in Phase-I, Phase-II & Phase-III 24.06.2025 28.06.2025 18 Students' Orientation in the college 24.06.2025 28.06.2025 19 Commencement of Classwork, Semester-I 30.06.2025

Detailed Guidelines for DOST(Degree Online Services Telangana)

- The Candidate should be of Indian Nationality.

- The candidate should satisfy ‘local’/’non-local’ status requirements as laid down in the Telangana Educational Institutions (Regulation of Admissions) Order, 1974, as subsequently amended (enclosed as Annexure-I).

- Candidates seeking admission into 1st year B.A./B.Sc./B.Com./B.Com.(Voc.)/B.Com.(Hons)/BSW/BBA/ BBM/BCA etc Degree Courses must have passed Two Year Intermediate Examination

- conducted by the Telangana State Board of Intermediate Education OR an Examination of any other University/Board recognized as equivalent thereto, (other than Pre-Degree Course in Oriental Languages of OU), as specified in the Annexure II.

- As per the Letter RC.No.51009/ERTW-III/2009-10, dt.06.05.2010 of the Secretary, Telangana State Board of Intermediate Education, the students, who completed first 2 years Course of RGUKT, IIT, Basara programme are also eligible.

- In respect to the candidates, who have passed Intermediate (Vocational) Courses from the Telangana State Board of Intermediate Education OR +2 Examination conducted by any Board other than listed in the Annexure-II, the candidates shall submit an equivalence certificate issued by the Telangana State Board of Intermediate Education.

- The Candidates who have passed a Diploma in Engineering/Technology/Non-Engineering Courses recognized by State Board of Technical Education & Training (SBTET), Telangana, are eligible for admission in the 1st Year in all the Degree Programmes as per G.O.Ms.No.112, Higher Education (TE.I) Department, dt.27.10.2001.

- Candidates who have passed qualifying examination with Science/Arts / Commerce subjects are eligible for admission to B.A./B.Com /BSW / BBA / BBM/BCA etc. Courses. Qualifying Examination means examination of the minimum qualification prescribed in these rules, passing of which entitles one to seek admissions into Undergraduate Courses.

- The Candidates who have passed Intermediate (Vocational) Medical Lab Technology Course from the Board of Intermediate Education, Telangana State OR from any other State equivalent to it are eligible for admission into B.A. /B.Com Courses only. However, those who have a Bridge Course Certificate along with Intermediate (Vocational) Medical Lab Technology are eligible for B.Sc. Courses.

- Candidates seeking admission into the B.Sc. 1st Year Course should have passed and secured an aggregate of 40% marks (a Pass only in the case of Scheduled Caste and Scheduled Tribes candidates) in the concerned Science Subjects (i.e. Physical Sciences and Mathematics OR Physical Sciences and Biological Sciences as the case may be) in the qualifying examination. Candidates who have passed the qualifying examination with Arts/Commerce subjects are NOT ELIGIBLE for admissions into the B.Sc. Course.

- Candidates who have passed Intermediate Examination with Mathematics, Economics and Commerce combination can be considered eligible for admission into (Mathematics, Statistics and Computer Science) combination of B.Sc only.

- Candidates seeking admission to BSW Course should have secured not less than 40% marks in aggregate at the qualifying examination (a pass only in the case of Scheduled Caste and Scheduled Tribes candidates).

Merit Criteria for admission into Undergraduate Courses through DOST Admissions (B.A. / B.Sc. /B.Com. /B.Com.(Voc)/B.Com.(Hons) /BSW /BBA /BBM/ BCA):

- The order of merit of the candidates shall be on the basis of the aggregate marks secured by the candidates in the qualifying examination. However, the aggregate marks awarded by other Boards will be normalized with that of Telangana State Board of Intermediate Education.

- In case of a tie in the aggregate marks, the following preferences shall be followed in the order: (a) the marks secured by the candidates in the optional subjects, (b) the marks secured in English Language and (c) the date of birth/ age of the candidate (senior in age getting priority).

- Two merit lists shall be prepared one in respect of all the candidates, who have passed the qualifying examination in single attempt and the other of the candidates who have passed in more than one attempt.

- Admissions to the 1st Year of the three year Degree Courses will be made in order of merit as per the options exercised by the candidates through DOST. Candidates who have passed the qualifying examination in parts or compartmentally shall be considered for admission, only after all the candidates who passed in single attempt under the respective category of Undergraduate Course are accommodated.

- Fraction of 0.5% and above secured by the candidates in the qualifying examination shall be treated as 1% wherever necessary in the calculation of percentage of marks (eg.39.5% and above shall be treated as 40%).

Allotment of Seats for B.Com through DOST (Degree Online Services Telangana):

Allotment of Seats for B.A through DOST (Degree Online Services Telangana):

Reservation for local Candidates through DOST (Degree Online Services Telangana)

Reservation for SC/ST/BC Communities for admission in to Degree through DOST (Degree Online Services Telangana)

Reservation for N.C.C in Degree Admissions through DOST (Degree Online Services Telangana)

- 1% of the seats are reserved for the students possessing the prescribed certificates in N.C.C. The selection of the candidates shall be made according to the G.O.Ms.No.14, Higher Education (TE) Department, dt.09.06.2017.

- If suitable candidate is not available for any seat in the above categories, the same shall be filled up from general pool on the basis of merit.

Reservation of seats for Games and Sports in Degree Admissions through DOST (Degree Online Services Telangana):

- Children of Armed Forces Personnel killed in action.

- Children of Armed Personnel disabled in action and invalidated out from service on Medical grounds.

- Children of Armed Forces Personnel who are in receipt of Gallantry Awards, the order of merit for consideration of the Gallantry Awards being as given below:

Reservation of Seats for Physically Challenged in Degree Admissions through DOST (Degree Online Services Telangana):

- Visually Challenged/Impaired - 1%

- Hearing Impaired - 1%

- Orthopeadically Challenged - 1%

Functions of the DOST Convener:

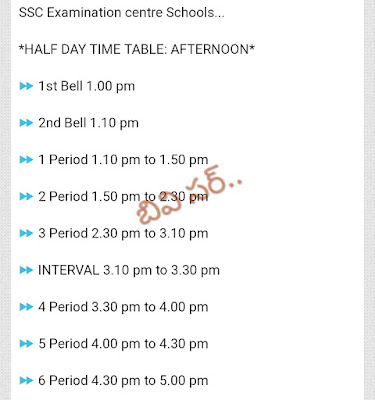

- The Convener shall decide the date of notification, immediately after the publication of Intermediate results.

- He shall decide the dates of registrations, dates for the publication of lists, dates for confirming the seats in all the phases. He will also declare the schedule for admissions.

- The Convener shall coordinate and supervise DOST activities right from ‘notification’ to the preparation of the final ‘Admission Registers’ and sending them to the Universities concerned by

- coordinating with the Telangana State Council of Higher Education and Commissioner of Collegiate Education Coordination Committees.

- All the candidates eligible to be declared as local candidates.

- Candidates who have resided in the State for a total period of 10 years excluding periods of study outside the State or either of whose parents have resided in the State for a total period of ten years excluding period of employment outside the State.

- Candidates who are children of parents who are in the employment of this State or Central Government, Public Sector Corporations, Local Bodies, Universities and other similar Quasi-Public Institutions, within the State.

- Candidates who are spouses of those in the employment of the State or Central Government, Public Sector Corporations, Local Bodies, Universities and Educational Institutions recognized by the Government or University OR Other Competent Authority and similar Quasi Government Institutions within the State.

- If a local candidate in respect of a local area is not available to fill any seat reserved or allocated in favour of a local candidate in respect of that local area, such seat shall be filled if it had not been reserved.

Visit the official website for DOST details

Degree Admissions through DOST Degree Online Services Telangana

Pre – requisites for DOST Registrations:

Admission Schedule, Degree Online Services Telangana (DOST)

| S.NO | Details | From | To |

|---|---|---|---|

| Phase I | |||

| 1 | Notification | 02.05.2025 | |

| 2 | Phase-I Registration (Registration fee Rs.200/-) | 03.05.2025 | 21.05.2025 |

| 3 | Phase-I Web-options | 10.05.2025 | 22.05.2025 |

| 4 | Verification of Special Category Certificates at University HelpLine Centers (UHLCs) |

||

| (i) PH/ CAP | 21.05.2025 | ||

| (ii) NCC/Sports/Extra-Curricular Activities | 22.05.2025 | ||

| 5 | Phase I Seat Allotment | 29.05.2025 | |

| 6 | Online Self-reporting by the seats allotted students | ||

University HelpLine Centers (UHLCs) (PH/CAP/NCC/Sports/Extra-Curricular Activities) 09.06.2025 10 Phase II Seat Allotment 13.06.2025 11 Online Self-reporting by the seats allotted students 13.06.2025 18.06.2025 Phase III 12 Phase III Registration (Registration fee Rs.400/-) 13.06.2025 19.06.2025 13 Phase III Web-options

13.06.2025 19.06.2025 14 Verification of Special Category Certificates at

University HelpLine Centers (UHLCs) (PH/ CAP/ NCC/ Extra-Curricular Activities) 18.06.2025 15 Phase III Seat Allotment 23.06.2025 16 Online Self-reporting by the seats allotted students 23.06.2025 28.06.2025 17 Reporting to colleges by the students who have already confirmed their seats online (self-reporting) in Phase-I, Phase-II & Phase-III 24.06.2025 28.06.2025 18 Students' Orientation in the college 24.06.2025 28.06.2025 19 Commencement of Classwork, Semester-I 30.06.2025

Detailed Guidelines for DOST(Degree Online Services Telangana)

- The Candidate should be of Indian Nationality.

- The candidate should satisfy ‘local’/’non-local’ status requirements as laid down in the Telangana Educational Institutions (Regulation of Admissions) Order, 1974, as subsequently amended (enclosed as Annexure-I).

- Candidates seeking admission into 1st year B.A./B.Sc./B.Com./B.Com.(Voc.)/B.Com.(Hons)/BSW/BBA/ BBM/BCA etc Degree Courses must have passed Two Year Intermediate Examination

- conducted by the Telangana State Board of Intermediate Education OR an Examination of any other University/Board recognized as equivalent thereto, (other than Pre-Degree Course in Oriental Languages of OU), as specified in the Annexure II.

- As per the Letter RC.No.51009/ERTW-III/2009-10, dt.06.05.2010 of the Secretary, Telangana State Board of Intermediate Education, the students, who completed first 2 years Course of RGUKT, IIT, Basara programme are also eligible.

- In respect to the candidates, who have passed Intermediate (Vocational) Courses from the Telangana State Board of Intermediate Education OR +2 Examination conducted by any Board other than listed in the Annexure-II, the candidates shall submit an equivalence certificate issued by the Telangana State Board of Intermediate Education.

- The Candidates who have passed a Diploma in Engineering/Technology/Non-Engineering Courses recognized by State Board of Technical Education & Training (SBTET), Telangana, are eligible for admission in the 1st Year in all the Degree Programmes as per G.O.Ms.No.112, Higher Education (TE.I) Department, dt.27.10.2001.

- Candidates who have passed qualifying examination with Science/Arts / Commerce subjects are eligible for admission to B.A./B.Com /BSW / BBA / BBM/BCA etc. Courses. Qualifying Examination means examination of the minimum qualification prescribed in these rules, passing of which entitles one to seek admissions into Undergraduate Courses.

- The Candidates who have passed Intermediate (Vocational) Medical Lab Technology Course from the Board of Intermediate Education, Telangana State OR from any other State equivalent to it are eligible for admission into B.A. /B.Com Courses only. However, those who have a Bridge Course Certificate along with Intermediate (Vocational) Medical Lab Technology are eligible for B.Sc. Courses.

- Candidates seeking admission into the B.Sc. 1st Year Course should have passed and secured an aggregate of 40% marks (a Pass only in the case of Scheduled Caste and Scheduled Tribes candidates) in the concerned Science Subjects (i.e. Physical Sciences and Mathematics OR Physical Sciences and Biological Sciences as the case may be) in the qualifying examination. Candidates who have passed the qualifying examination with Arts/Commerce subjects are NOT ELIGIBLE for admissions into the B.Sc. Course.

- Candidates who have passed Intermediate Examination with Mathematics, Economics and Commerce combination can be considered eligible for admission into (Mathematics, Statistics and Computer Science) combination of B.Sc only.

- Candidates seeking admission to BSW Course should have secured not less than 40% marks in aggregate at the qualifying examination (a pass only in the case of Scheduled Caste and Scheduled Tribes candidates).

Merit Criteria for admission into Undergraduate Courses through DOST Admissions (B.A. / B.Sc. /B.Com. /B.Com.(Voc)/B.Com.(Hons) /BSW /BBA /BBM/ BCA):

- The order of merit of the candidates shall be on the basis of the aggregate marks secured by the candidates in the qualifying examination. However, the aggregate marks awarded by other Boards will be normalized with that of Telangana State Board of Intermediate Education.

- In case of a tie in the aggregate marks, the following preferences shall be followed in the order: (a) the marks secured by the candidates in the optional subjects, (b) the marks secured in English Language and (c) the date of birth/ age of the candidate (senior in age getting priority).

- Two merit lists shall be prepared one in respect of all the candidates, who have passed the qualifying examination in single attempt and the other of the candidates who have passed in more than one attempt.

- Admissions to the 1st Year of the three year Degree Courses will be made in order of merit as per the options exercised by the candidates through DOST. Candidates who have passed the qualifying examination in parts or compartmentally shall be considered for admission, only after all the candidates who passed in single attempt under the respective category of Undergraduate Course are accommodated.

- Fraction of 0.5% and above secured by the candidates in the qualifying examination shall be treated as 1% wherever necessary in the calculation of percentage of marks (eg.39.5% and above shall be treated as 40%).

Allotment of Seats for B.Com through DOST (Degree Online Services Telangana):

Allotment of Seats for B.A through DOST (Degree Online Services Telangana):

Reservation for local Candidates through DOST (Degree Online Services Telangana)

Reservation for SC/ST/BC Communities for admission in to Degree through DOST (Degree Online Services Telangana)

Reservation for N.C.C in Degree Admissions through DOST (Degree Online Services Telangana)

- 1% of the seats are reserved for the students possessing the prescribed certificates in N.C.C. The selection of the candidates shall be made according to the G.O.Ms.No.14, Higher Education (TE) Department, dt.09.06.2017.

- If suitable candidate is not available for any seat in the above categories, the same shall be filled up from general pool on the basis of merit.

Reservation of seats for Games and Sports in Degree Admissions through DOST (Degree Online Services Telangana):

- Children of Armed Forces Personnel killed in action.

- Children of Armed Personnel disabled in action and invalidated out from service on Medical grounds.

- Children of Armed Forces Personnel who are in receipt of Gallantry Awards, the order of merit for consideration of the Gallantry Awards being as given below:

Reservation of Seats for Physically Challenged in Degree Admissions through DOST (Degree Online Services Telangana):

- Visually Challenged/Impaired - 1%

- Hearing Impaired - 1%

- Orthopeadically Challenged - 1%

Functions of the DOST Convener:

- The Convener shall decide the date of notification, immediately after the publication of Intermediate results.

- He shall decide the dates of registrations, dates for the publication of lists, dates for confirming the seats in all the phases. He will also declare the schedule for admissions.

- The Convener shall coordinate and supervise DOST activities right from ‘notification’ to the preparation of the final ‘Admission Registers’ and sending them to the Universities concerned by

- coordinating with the Telangana State Council of Higher Education and Commissioner of Collegiate Education Coordination Committees.

- All the candidates eligible to be declared as local candidates.

- Candidates who have resided in the State for a total period of 10 years excluding periods of study outside the State or either of whose parents have resided in the State for a total period of ten years excluding period of employment outside the State.

- Candidates who are children of parents who are in the employment of this State or Central Government, Public Sector Corporations, Local Bodies, Universities and other similar Quasi-Public Institutions, within the State.

- Candidates who are spouses of those in the employment of the State or Central Government, Public Sector Corporations, Local Bodies, Universities and Educational Institutions recognized by the Government or University OR Other Competent Authority and similar Quasi Government Institutions within the State.

- If a local candidate in respect of a local area is not available to fill any seat reserved or allocated in favour of a local candidate in respect of that local area, such seat shall be filled if it had not been reserved.

Visit the official website for DOST details